Fixed vs. Variable Costs: What Startups Should Know

Learn the difference between fixed and variable costs. Discover how smart accounting and bookkeeping services help startups manage both.

Understanding your cost structure is fundamental to financial management.

At Ceptrum, we help startups navigate these financial fundamentals through our Accounting and bookkeeping services for startups. Here’s how fixed and variable costs impact your business and strategies to optimize both.

Understanding Fixed vs. Variable Costs with the Help of an Accounting and Bookkeeping Service for Startups

1. Defining Cost Types

Fixed Costs (Overhead)

- Definition: Expenses that remain constant regardless of production/sales

- Examples:

- Rent/lease payments

- Salaries (fixed component)

- Insurance premiums

- Software subscriptions (Xero accounting software fees)

Variable Costs (Production Costs)

- Definition: Expenses that fluctuate with business activity

- Examples:

- Raw materials

- Sales commissions

- Payment processing fees

- Shipping costs

Ceptrum Insight: Our startup accounting services automatically categorize these costs in your QuickBooks for small business dashboard.

2. Impact on Business Operations

A. Pricing Strategy

✔ Fixed costs require minimum sales volume to cover

✔ Variable costs determine marginal profitability

✔ Breakeven analysis depends on both cost types

Ceptrum Tool: We build cost-volume-profit models for clients using Xero accounting software data.

B. Cash Flow Management

- Fixed costs create consistent cash outflows

- Variable costs scale with revenue fluctuations

- High fixed cost businesses need larger cash reserves

Stat Alert: Startups with >40% fixed costs have 3x higher failure rates in recessions (Harvard Business Review).

C. Scaling Decisions

- Businesses with high variable costs scale more efficiently

- High fixed cost businesses benefit from operational leverage

- Outsourcing converts fixed to variable costs (like our small company bookkeeping services)

4. Industry-Specific Cost Structures

| Industry | Typical Fixed Cost % | Typical Variable Cost % |

| SaaS | 70-80% | 20-30% |

| Manufacturing | 40-50% | 50-60% |

| Consulting | 30-40% | 60-70% |

| Retail | 50-60% | 40-50% |

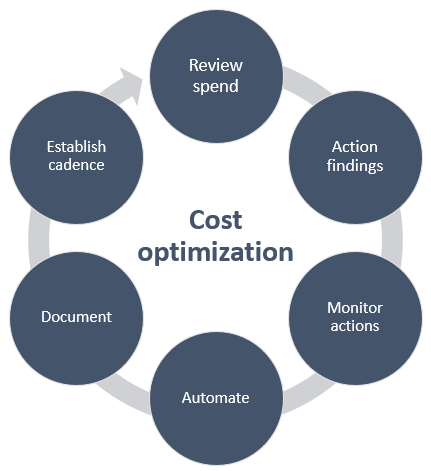

5. Strategic Cost Optimization

For Fixed Costs:

✔ Renegotiate leases/contracts annually

✔ Implement hybrid work to reduce office space

✔ Bundle software tools (e.g., QuickBooks for small business payroll + accounting)

For Variable Costs:

✔ Negotiate volume discounts with suppliers

✔ Implement just-in-time inventory

✔ Automate processes to reduce labor costs

Ceptrum Case Study: Reduced a client’s fixed costs by 22% through SaaS optimization and remote work transition.

6. Cost Analysis Tools

✔ Break-even Calculator: Determines minimum sales needed

✔ Contribution Margin Analysis: (Price – Variable Cost)/Price

✔ Operating Leverage Ratio: Fixed Costs/Total Costs

Our Process: These analyses are included in our startup accounting services financial reviews.

7. Common Mistakes to Avoid

- Miscategorizing semi-variable costs (e.g., utilities)

- Ignoring step-fixed costs that jump at certain thresholds

- Underestimating variable cost inflation

- Over-leveraging fixed costs before stable revenue

8. When Costs Become Tax Strategies

✔ Fixed costs often fully deductible

✔ Variable costs reduce taxable income

✔ R&D credits may apply to certain variable costs

Ceptrum tax services for startups ensure optimal cost treatment.

9. Future-Proofing Your Cost Structure

✔ Build contingency plans for fixed cost coverage

✔ Create variable cost benchmarks by product line

✔ Monitor cost ratios monthly in your Xero accounting software

10. Ceptrum’s Cost Management Solutions

We help clients:

✅ Categorize fixed vs. variable costs accurately

✅ Model different cost structure scenarios

✅ Implement cost-tracking automation

✅ Develop sustainable reduction strategies

Understanding your cost structure isn’t about cutting expenses—it’s about strategic investment. We help find the right balance for growth. – Ceptrum Team

Ready to Optimize Your Cost Structure?

📉 Take our Cost Structure Health Check

📊 Schedule a free financial analysis

📲 Connect your QuickBooks for small business for instant insights

Next Steps:

- Analyze your current fixed/variable cost ratio

- Identify one fixed cost to renegotiate

- Set up cost-tracking automation

With Ceptrum, accounting and bookkeeping services for startups, turn your cost structure into a competitive advantage. Let’s build a financially efficient business together!