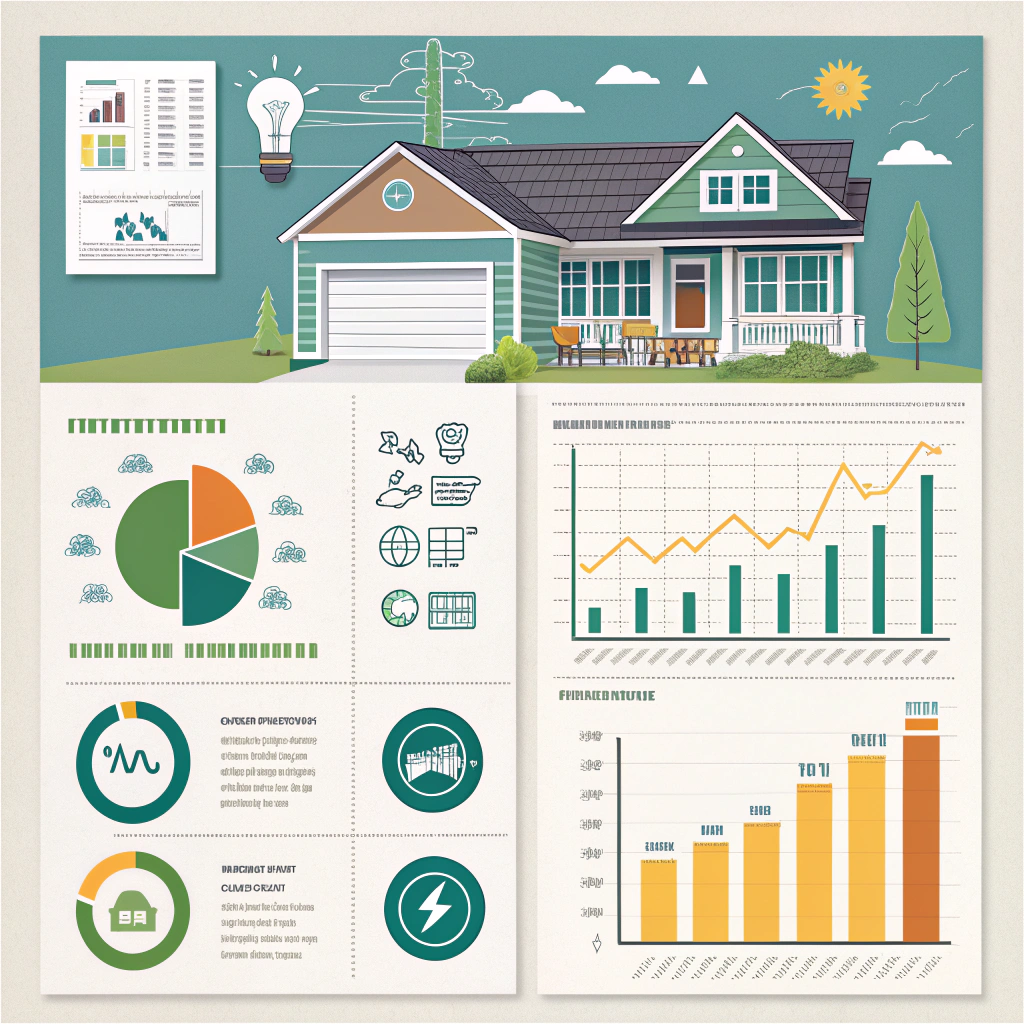

First-Time Buyers in California: Mortgage Rates and Energy-Smart Financing You Should Know

If you’re thinking of buying a home in California this year, you’re probably already bracing yourself for big price tags and competitive markets. But there’s good news too: smart financing options are available—including energy saver home loan programs—that can make homeownership more affordable and eco-friendly.

Before you sign on the dotted line, let’s break down two essential things every California buyer should understand: the average interest rate for mortgage in California and how to finance energy-efficient upgrades right from the start.

What’s the Average Mortgage Interest Rate in California?

As of mid-2025, the average interest rate for a 30-year fixed mortgage in California is roughly 6.9%, according to national and state lending reports. While this is higher than the historic lows of recent years, it’s consistent with current economic policy and inflation control efforts.

Rates may vary depending on:

Your credit score

Loan term (15-year vs 30-year)

The type of loan (conventional, FHA, VA, etc.)

Your down payment

💡 Tip: Get multiple quotes from local and online lenders. Even a 0.25% difference in your rate could save you thousands over the life of your loan.

Thinking Green? Consider an Energy Saver Home Loan Program

In California, energy efficiency isn’t just a lifestyle—it’s a smart financial move. With utility costs rising and climate resilience becoming more important, many new homeowners are looking into energy saver home loan programs to fund upgrades like:

Solar panels

Energy-efficient HVAC systems

Smart thermostats

Improved insulation and windows

Battery storage systems

Here are some standout programs to consider:

Popular Energy Saver Home Loan Programs in California

1. GoGreen Home (by CAEATFA)

A statewide initiative helping homeowners and renters finance energy-saving improvements through participating lenders. Ideal for those who want to modernize their home without a high upfront cost.

Loans start around $2,500

Applies to hundreds of energy upgrades

No lien is placed on your home

2. FHA Energy Efficient Mortgage (EEM)

Buyers using an FHA loan can fold energy-efficient improvements into the mortgage. You get the upgrades you want without increasing your monthly costs dramatically.

Great for first-time buyers

Includes home energy assessments

Helps reduce energy bills immediately

3. PACE (Property Assessed Clean Energy)

PACE financing is offered in many California cities and allows you to pay for improvements via your property taxes.

Doesn’t affect personal credit

Transferable to new owners

Watch out: it may impact refinancing options

4. Self-Help Federal Credit Union Green Loans

Offers affordable, fixed-rate loans for green home improvements, with a mission to serve underserved communities in California.

Combine Smart Mortgage Planning with Green Financing

Here’s how a first-time buyer in California can maximize both affordability and sustainability:

Lock in the best mortgage rate possible—comparison shop, negotiate, and know your credit score.

Choose a home with energy-saving potential—look for homes eligible for green upgrades.

Use an energy saver home loan program to finance upgrades like solar or insulation, reducing monthly utility bills from day one.

Enjoy lower total cost of ownership—fewer energy expenses and better resale value.

Final Thoughts

Yes, California homes are expensive—but with a strategic approach, you can turn a good buy into a great investment. Knowing the average interest rate for mortgage in California helps you budget, while tapping into energy saver home loan programs helps you build long-term value and sustainability.

It’s not just about buying a home—it’s about buying smart.